Money Like A Woman

There’s a better approach to finances that’s inclusive, collaborative, and a win-win for all.

Supporting Women in Business | Apply for The Visionary Awards, presented at the ReImagine Conference June 10th, 2025. Apply now!

Today’s featured rates

[1] APR = Annual Percentage Rate.

Auto Loan Disclosures:

Rates and terms accurate as of --/--/---- and are subject to change without notice. All offers of credit are subject to credit approval; not all applicants will qualify for the lowest rate and may be offered credit at higher rates and other terms based on creditworthiness. Rates and payment examples assume excellent borrower credit history, a 60-month term and a loan-to value (LTV) of 90% or less. Minimum auto loan amount is $3,750. Rate applies to loan amounts up to a maximum of $100,000.

NEW AUTO LOAN. Loan rates and terms applicable to new vehicles only. New vehicles are defined as the current or previous model year vehicle with less than 5,000 miles. Payment Example: For a term of 60-months based on new car rate of 6.38% APR; estimated monthly payment of $19.51 per $1,000.00 borrowed.

All credit products are subject to credit and collateral approval. Rates, loan programs, terms, and conditions are subject to change without notice. FourLeaf does not finance auto purchases from vehicle auction sites. Additional restrictions and limitations may apply. To obtain a loan product from FourLeaf, membership is required by opening a minimum $5.00 share savings account prior to loan closing.

Read More

[2] APY = Annual Percentage Yield.

10 Month Certificate Disclosures:

APY is accurate as of --/--/---- and is subject to change without notice. APY assumes all dividends remain in the certificate until maturity, and a withdrawal of dividends will reduce earnings. Penalties may be imposed for early withdrawal. The required minimum balance to open account and earn APY is $50.00. Fees may reduce earnings.

Student Savings Account Disclosures:

APY = Annual Percentage Yield. APY is accurate as of --/--/---- and subject to change, including after account opening, without notice. The Student Savings account is a variable rate tiered account. Balances $0.00 to $1,000.00 earn 5.00% APY and 4.91% dividend rate. Balances $1,000.01 to $10,000.00 earn 5.00% - 1.39% APY range and 1.00% dividend rate. $10,000.00 balance is an illustrative example for APY computation purposes only. There is no maximum balance for Student Savings accounts. The dividend rate is paid on the portion of the daily balance within each balance tier. The required minimum balance to open account is $5.00. Fees may reduce earnings.

Free Checking Disclosures:

APY is accurate as of --/--/---- and is subject to change, including after account opening, without notice. APY will apply for each month that the member (i) is enrolled in online banking with eStatements, (ii) receives a direct deposit into the Free Checking account, and (iii) makes 10 point-of-sale debit card transactions from the Free Checking account. Qualifying transactions must post to the Free Checking account by the last day of the month. If qualifying requirements are not met in any given month, then the Free Checking account will not earn dividends and 0.00% APY. There is no minimum balance requirements to earn APY and to open account.

Read More

What is FourLeaf known for?

For more information, visit our Member Advocacy page.

Take advantage of new ways to bank with us including in-person, video, or phone appointments.

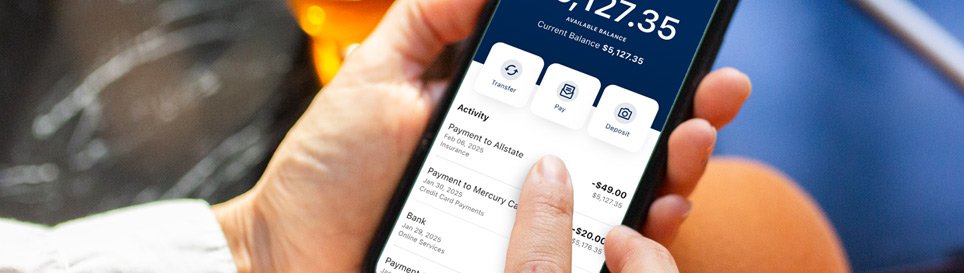

The convenience of FourLeaf right at your fingertips. Access your accounts 24/7, deposit checks on the go, and send money to friends and family with Zelle®.

Zelle Disclosure Language Apple, the Apple logo, Apple Pay, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.Android, Google Play, and the Google Play logo are trademarks of Google Inc.

02262025658